Optimism in Cyclical Downturn

Reading economic news during a cyclical downturn can be

depressing. Crack open the business news section and you are likely

to see at least one article that includes the words ‘China,’ ‘slowdown,’

‘oil,’ or ‘fear.’ Fear is so ingrained in the business world that the

Chicago Board Options Exchange Volatility Index, a measure of

market expectations of short-term stock market volatility, has been

more viscerally renamed as the “fear index.”

It is difficult to maintain one’s perspective and objectivity instead

of succumbing to knee jerk negativity, especially when conducting

a quick scan of doom and gloom headlines. This can be further

complicated if your coworkers subscribe to such pessimism. However,

it is critical to put the current economic slowdown in context and

respond rationally. During a cyclical downturn, management needs

to identify the expected duration of the downturn, apply appropriate

cash-saving methods, then quickly pivot toward preparing for the

impending economic upswing in order to maximize profits and

market share.

First, consider the current and expected future status of the electrical

industry. US Wholesale Trade of Electrical and Electronic Goods for

the 12 months ending in August totaled $575.8 billion. This is up

7.3% from the total one year ago, but represents a slowdown from

a peak annual growth rate of 8.7% in March. Internal trends suggest

the slowdown will extend into at least early 2016. Meanwhile,

prices for nonferrous cable and wire are also in a period of cyclical

decline.

In September the US Nonferrous Wire and Cable Producer Price Index was 7.8% below its level from one year ago, the steepest rate of contraction in over three years. US Electrical Equipment,

Appliances and Components New Orders are headed toward an

imminent recession. However, the recession will be brief and mild,

with accelerating growth starting in the second quarter of 2016 and

persisting through mid-2017.

Based on the last 20 years of data, periods of cyclical decline in new

orders nearly always correspond to contemporaneous or subsequent

periods of cyclical decline in wholesale trade. While two severe,

extended downturns in new orders led to contraction in wholesale

trade, the mild downturn in 2013/2014 led to only a slowdown in

wholesale trade. The 2013/2014 new orders recession is in line with

the expected duration and magnitude of the upcoming new orders

recession, making it a better comparable case. Thus, wholesale trade

is likely to exhibit slower growth into early 2016 before accelerating

around the second quarter of 2016.

The electrical industry is experiencing cyclical decline, but 2016

should be a better year than 2015. Leading with optimism means you

need to communicate these figures to your colleagues. Inform them

that there are important steps the company must take to protect itself

from the current downturn as well as to prepare for the impending

upswing.

Companies should carefully balance undertaking cash saving

measures now with preparing for 2016 expansion, particularly in the

second half of the year. Start by conducting a thorough analysis of your

sales, production, and distribution processes. Are there bottlenecks that will occur when a stronger 2016 arrives? If so, what is the lead

time necessary to incorporate new equipment or hire and train new

employees? If your company is in recession, to the extent you can

push back investments until recovery is underway and still meet the

increased 2016 demand, you should. You should also be cautious

about overextending credit or maintaining large inventories during

the slowdown. Companies in recession should eliminate overtime

and overhead positions that are non-essential and/or do not require

extensive training in lead up to 2016 expansion. Finally, consider

cutting prices. Many input costs have fallen. Framing a price cut as

a temporary passing on of such savings to customers may increase

your profitability in the short term while giving you the rationale to

raise prices when the economy turns up again as input costs rise.

At the same time you are undertaking these cost cutting measures,

you should recognize that the slowdown has led many commodities

and assets to be undervalued. You should carefully monitor key price

inputs and lock in low prices when there are early signs of rise in

order to improve profitability during the 2016 economic expansion.

Also, be cognizant of the likelihood that interest rates will rise and

that borrowing costs on equipment will be more expensive in 2016

than in 2015. If there are key pieces of equipment you need in order

to meet demand and that equipment is available at a low price and

cheap financing rates, it may make sense to buy now. This is especially

the case if the new equipment is expected to require significant time

to integrate into your production process. You also may want to

consider acquisitions of undervalued competitors, especially if you

foresee such acquisitions enabling you to improve market share and

profitability in 2016.

In sum, providing positive, forward-looking leadership during a

cyclical downturn can be challenging, but there are many actions

you can take to strengthen your business during a downturn. Do

not subscribe to fear-based leadership during this time. Instead, take

action, and take comfort in knowing that 2016 will be a better year

than 2015.

*Source - IEWC contracts the services of a third party consultant to provide current insights on the economy.

NORTH AMERICA Growth in North America is

decelerating, with Canada being hit

the hardest. Canada will enter a brief recession by the end of

2015. The United States and Mexico will experience slower

growth but avoid recession. 2016 will be a better year than

2015, particularly in the second half of 2016. By the end of

2016 expect 3.7% year-over-year growth in the US, 2.7%

growth in Canada, and 3.8% growth in Mexico.

The annual growth rate for US industrial production is 2.6%,

down from a peak of 3.9% growth in February. Production will

slow further through the end of the year and in early 2016

before growth accelerates in the second quarter of 2016. Job

growth has slowed to an average of 139,000 non-farm jobs per

month for August and September, just over half the 247,000

jobs the economy averaged over the prior 18 months. Annual

wholesale trade nondurable goods in the US is down 4.7%

and US nondefense capital goods new orders, a measure of

business-to-business activity, is headed for an imminent,

though short-lived, recession.

The average Canadian industrial production for the most

recent 12 months is 1.0% above the average over the previous

12 months. Production is headed toward a brief year-overyear

recession by the end of the year. However, recovery will

take hold in early 2016, with acceleration lasting throughout

the year and into early 2017. Canadian retail sales are up 3.1%

year-over-year, but growth is slowing. Canadian durable goods

new orders are in recession.

Average Mexican industrial production over the last 12

months is 1.5% over the average from one year ago. Mexican

machinery and equipment production and Mexican mining

production are dragging on Mexican industrial production,

down 2.0% and 5.9% respectively on a year-over-year basis.

Mexican light vehicle production is a bright spot, expanding

at an annual rate of 9.8%.

SOUTH AMERICA Brazil is weighing on the region. Annual Brazilian industrial production is down 5.7% from one year ago. The Brazil leading indicator has yet to point toward a future recovery in Brazilian industrial production. Annual Brazil exports, many of which are heavily dependent on demand from China, are down 17.7% from one year ago. The rate of year-over-year contraction in Argentine industrial production is easing. The macroeconomy is benefitting from 6.2% annual growth in construction activity. Expect Chile industrial production to head toward a recession by the end of 2015 due to weakness in copper exports and mining. Colombian industrial production is already in recession (annual growth of negative 0.4%). Annual colombian mining and quarrying is 15.5% below its level from one year ago, though consumer spending (Colombian retail sales annual growth of 7.4%) is helping to mitigate the mining downturn seen on the producer side of the Colombian economy.

EUROPE Annual growth in Western Europe

industrial production rose to 0.7% in

July. Quarterly production in Germany was up 4.2%,

the highest quarterly growth rate since October 2011.

However, the German leading indicator is pointing to a

cyclical low in German industrial production in 4Q15,

suggesting the current upturn to 1.6% annual growth may

be short-lived, especially given German export woes

(contracting at an annual rate of 6.2%) and potential fallout

from the Volkswagen emissions scandal.

The U.K., France,

Italy, and Spain

are all

experiencing

accelerating

growth, though

of this group,

only Spain has

an annual

growth rate

exceeding 2.0%.

Annual growth in Eastern Europe

industrial production ticked up to

1.2% in August, tentatively signaling

the formation of a cyclical low in June.

Poland, which accounts for 42% of Eastern Europe

industrial production, is a growth driver (annual growth

of 4.2%). Expect Eastern Europe industrial production

to grow at 1.2% in 2015, and 3.6% in 2016.

ASIA Annual growth in China industrial production held steady at 6.8% in August, the same growth rate as July. However, the Chinese leading indicators have yet to point toward reacceleration. Slower growth persists in Southeast Asia, which is expected to fall into recession by the end of the year. In contrast, the rate of contraction of the Japanese economy, as measured by industrial production, is easing. India is showing resiliency, making a tentative transition to accelerating growth in spite of declining exports.

MIDDLE EAST / AFRICA Industrial production in the Middle East and North Africa (MENA) region is rising at an annual growth rate of 2.2%. However, the Middle East’s oil competition seems to be hurting more than benefitting most governments at this time. Egypt has already begun slowing ahead of the region, a sign that the overall MENA economy will soon experience deceleration.

*Source - IEWC contracts the services of a third party consultant to provide current insights on the economy.

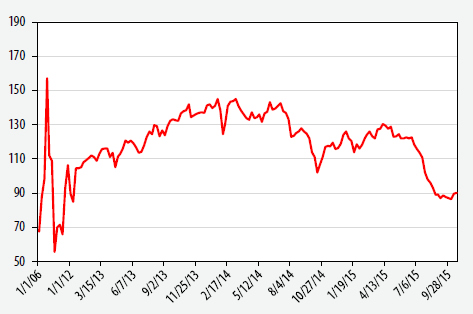

Wire Index

The Wire Index increased modestly by 0.9% from the beginning of September

through October 19th. Year-to-date, the Index is down 26.1% and down 15.6%

over the past 12 months. Since the beginning of September, the stock price

for Encore has increased by 17%. Meanwhile, Houston Wire & Cable’s stock

price fell by 19%. Visit http://iewc.info/wireindex for more information

and historical data.

The Index tracks the weighted stock price of five publicly-traded wire and cable

manufacturers and distributors based in the US and is benchmarked such that

the average value during the second half of 2006 equals 100.

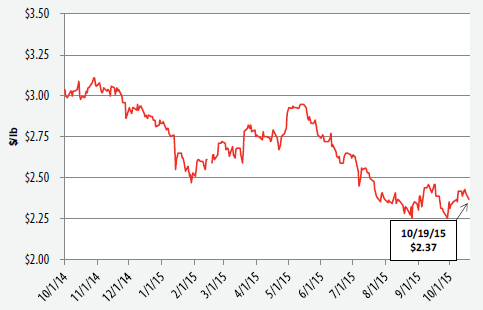

Comex copper prices

Comex copper prices increased by 3% from September 1st to October 19th, moving from $2.30 to $2.37 per pound. It is still down 16.3% since the beginning of 2015 and down 20.7% over the past twelve months.

- Pre:DUTEAA Membership 2015/11/14

- Next:New Homepage Online 2015/10/29